Table of Contents

Introduction to Binance & Its Fee Structure

✅ What is Binance?

Binance is one of the world’s largest and most popular cryptocurrency exchanges, offering a wide range of trading services, including spot trading, futures trading, margin trading, staking, and more. Established in 2017, Binance quickly gained traction due to its competitive fees, deep liquidity, and extensive list of supported cryptocurrencies. With millions of users worldwide, Binance has become a go-to platform for both beginner and professional traders.

✅ Why Trading Fees Matter for Crypto Traders?

Trading fees can significantly impact a trader’s profitability, especially for high-frequency or large-volume traders. Understanding Binance’s fee structure helps users:

- Reduce unnecessary costs by optimizing their trading strategy.

- Maximize profits through fee discounts, cashback programs, and promotions.

- Choose the right trading platform based on overall cost efficiency.

✅ Binance Fees Compared to Other Major Exchanges

Binance is known for offering some of the lowest trading fees in the market. Here’s how its standard trading fees compare to other leading exchanges:

- Binance Spot Trading Fees: Maker 0.1% | Taker 0.1% (with potential discounts).

- Binance Futures Trading Fees: Maker 0.02% | Taker 0.04%.

- Comparison with competitors:

- Bybit: 0.1% spot fees, 0.01%/0.06% futures fees.

- OKX: 0.08% spot fees, 0.02%/0.05% futures fees.

- KuCoin: 0.1% spot fees, 0.02%/0.06% futures fees.

- Bitget: 0.1% spot fees, 0.02%/0.06% futures fees.

Binance also offers additional fee reductions through BNB fee discounts, VIP levels, and referral cashback programs, making it one of the most cost-effective exchanges for traders.

Binance Fees Breakdown & How They Work

📊 Spot Trading Fees (Binance Spot Fees)

Binance charges competitive fees for spot trading:

✔ Maker Fee: 0.1%

✔ Taker Fee: 0.1%

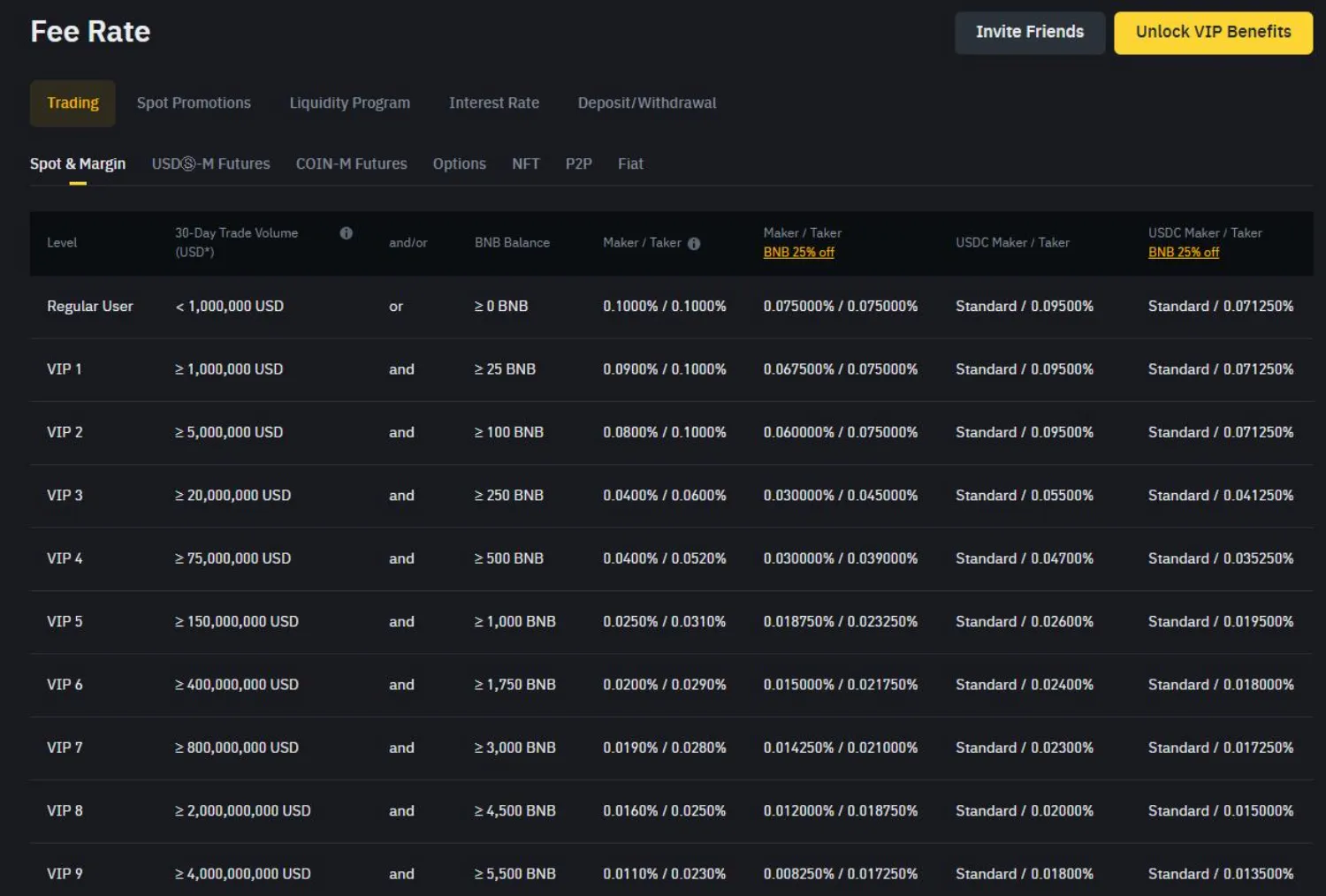

However, traders can reduce their spot trading fees using:

- BNB Fee Discount – Pay fees with Binance Coin (BNB) to get a 25% discount, reducing fees to 0.075% for both maker and taker orders.

- VIP Program – Binance offers VIP levels (VIP 1 – VIP 9) where high-volume traders get further discounts.

- Referral Cashback – Users joining via a referral link may receive additional cashback on trading fees.

💰 Binance Zero-Fee Trading Pairs

Binance frequently offers zero-fee spot trading pairs for major assets like BTC, ETH, and stablecoins. This allows traders to buy and sell selected cryptocurrencies without paying any trading fees.

🔹 Binance Spot Fees vs Competitors

| Exchange | Maker Fee | Taker Fee | BNB Discount | VIP Levels |

|---|---|---|---|---|

| Binance | 0.1% | 0.1% | ✅ -25% (0.075%) | ✅ (VIP 1-9) |

| OKX | 0.08% | 0.1% | ❌ | ✅ |

| Bybit | 0.1% | 0.1% | ❌ | ✅ |

| KuCoin | 0.1% | 0.1% | ✅ -20% (0.08%) | ✅ |

| Bitget | 0.1% | 0.1% | ❌ | ✅ |

📊 Futures Trading Fees (Binance Futures Fees)

Binance Futures offers even lower fees compared to spot trading:

✔ Maker Fee: 0.02%

✔ Taker Fee: 0.04%

🔹 How to Lower Binance Futures Fees?

- BNB Discount – Get 10% off on futures fees when paying with BNB.

- VIP Levels – Higher trading volume reduces fees (VIP 1-9).

- Referral Cashback – Users can earn up to 40% fee cashback.

🔹 Binance API & App Trading Fees

- API Trading Fees – Same as standard futures fees but may vary depending on volume-based discounts.

- App Trading Fees – No extra charges; the same fees apply when trading via the Binance mobile app.

📊 Funding Fees & Margin Trading Costs

🔹 What is Binance Funding Fee?

Funding fees apply to perpetual futures contracts to balance price differences between spot and futures markets.

- Funding rates change every 8 hours based on market conditions.

- If the funding rate is positive, long traders pay short traders.

- If the funding rate is negative, short traders pay long traders.

💰 Example Calculation:

- BTC/USDT funding rate = 0.02%

- $10,000 position size

- Fee = 0.02% of $10,000 = $2 per 8 hours

🔹 How to Reduce Funding Fees?

- Trade futures contracts with lower funding rates.

- Open positions just before funding settlement and close them after.

- Use hedging strategies to balance long and short positions.

🔹 Binance BEP-20 & BEP2 Transaction Fees

- BEP-20 Fees: These fees apply to Binance Smart Chain (BSC) token transfers.

- BEP2 Fees: Apply to Binance Chain transactions.

- Transaction costs vary based on network congestion.

📊 Deposit & Withdrawal Fees

✔ Binance Deposit Fee: FREE for all cryptocurrencies.

✔ Binance Withdrawal Fees: Fees depend on the cryptocurrency and network used.

🔹 Withdrawal Fee Examples (BTC, ETH, USDT, BNB)

| Coin | Network | Withdrawal Fee |

|---|---|---|

| BTC | Bitcoin | 0.0002 BTC |

| ETH | ERC-20 | 0.0012 ETH |

| USDT | ERC-20 | 2 USDT |

| USDT | TRC-20 | 0.8 USDT |

| BNB | BEP-20 | 0.0005 BNB |

🔹 Other Binance Transaction Fees

- Binance Convert Fee: Applies when swapping one crypto for another using the Binance Convert tool.

- Binance Card Fee: Some fees apply to Binance Visa Card transactions.

- Binance Advcash Fees: Deposits via Advcash may have small processing fees.

How to Get Binance Cashback & Reduce Trading Costs?

📌 What is Binance Cashback & How It Works?

Binance cashback is a trading fee rebate program that helps traders save on spot and futures trading fees. Cashback is based on:

✔ VIP Level Discounts – Higher VIP levels get lower fees.

✔ Referral Cashback – Traders who sign up through special referral links can get up to 41% cashback.

💰 Binance Cashback Rates:

- Spot Cashback: Up to 41%

- Futures Cashback: Up to 40%

🔹 Why Binance Cashback Matters?

- Saves money on every trade.

- Helps high-volume traders maximize profits.

- Can be combined with BNB fee discounts for even lower fees.

📌 How to Register for Binance Cashback?

Getting cashback on Binance is easy and only takes a few steps.

🔹 Step-by-Step Guide to Binance Cashback Registration:

1️⃣ Sign up for Binance using a referral link with cashback benefits.

2️⃣ Verify your account (KYC) to unlock cashback eligibility.

3️⃣ Start trading on Spot or Futures.

4️⃣ Binance automatically applies cashback to reduce fees on every trade.

🔹 Binance Referral Program vs. Binance Cashback Program

| Feature | Binance Referral | Binance Cashback |

|---|---|---|

| Who gets rewards? | Both inviter & invitee | Only the invitee |

| How much? | 5%-20% rebate | Up to 41% cashback |

| Spot Cashback | ✅ Yes | ✅ Yes |

| Futures Cashback | ✅ Yes | ✅ Yes |

| Requires special link? | ✅ Yes | ✅ Yes |

💡 Tip: Traders should always check their referral link details to ensure maximum cashback eligibility.

📌 Cashback Comparison: Binance vs. Other Exchanges

| Exchange | Max Cashback % | Requirements | Cashback Type |

|---|---|---|---|

| Binance | 41% | VIP level or referral | Spot & Futures Cashback |

| Bybit | 40-45% | Volume-based | Cashback & Bonus |

| Bitget | 40-47% | High volume traders | Cashback tiers |

| Phemex | 30% | Requires application | Trading fee rebate |

| KuCoin | 60% | VIP users | Cashback & Discounts |

💡 Key Takeaway: Binance cashback is one of the most competitive programs, especially for spot and futures traders who trade frequently.

📌 Trader Case Study: How Much Can You Save?

🔹 Meet Trader Mike – A High-Volume Futures Trader

Mike is an active futures trader who uses Binance Futures to trade daily. Let’s break down how much he can save with Binance cashback.

🔹 Trader Mike’s Profile:

- Trading Type: Binance Futures.

- Starting Capital: $10,000 per trade.

- Leverage Used: 20x (which means he trades with a $200,000 position size per trade).

- Daily Trade Volume: $20,000 (since he opens and closes a $10,000 leveraged position).

- Trading Days Per Month: 30 days.

- Monthly Trading Volume: $600,000 ($20,000 per trade × 30 days).

🔹 Standard Binance Futures Fees (Without Cashback)

💰 Binance Futures Trading Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.04%

- Total Monthly Trading Volume: $600,000

💰 Fees Without Cashback:

- Maker Fee Cost: 0.02% × $600,000 = $120

- Taker Fee Cost: 0.04% × $600,000 = $240

- Total Trading Fees: $360 per month

🔹 Fees With 40% Binance Cashback

If Mike signs up for Binance through a 40% cashback referral, he gets a rebate on his trading fees.

💰 Cashback Savings Calculation:

- Maker Fee Rebate: 40% of $120 = $48 saved

- Taker Fee Rebate: 40% of $240 = $96 saved

- Total Savings: $144 per month

🔹 Final Comparison – How Much Does Mike Save?

| Fee Type | Without Cashback | With 40% Cashback | Savings |

|---|---|---|---|

| Maker Fee | $120 | $72 | $48 saved |

| Taker Fee | $240 | $144 | $96 saved |

| Total Fees | $360 | $216 | $144 saved per month |

🔥 Total Annual Savings: $1,728 saved per year!

💡 Key Takeaways:

- Without cashback, Mike pays $360 per month in Binance Futures trading fees.

- With 40% cashback, he reduces his fees to $216 per month, saving $144 monthly.

- Over a year, Mike saves $1,728 just by using a Binance cashback referral.

👉 Want to save like Mike? Sign up for Binance cashback today and cut your trading fees by up to 41%! 🚀

Binance vs. Other Exchanges: Trading Fees & Cashback Comparison

When choosing a crypto exchange, trading fees and cashback programs play a crucial role in maximizing profits. Let’s compare Binance with major competitors like Bybit, OKX, KuCoin, and Bitget across spot trading fees, futures fees, funding rates, withdrawal fees, and cashback programs.

📊 Spot & Futures Trading Fees Comparison

Binance generally offers competitive fees, but how does it stack up against other major exchanges?

| Exchange | Spot Maker Fee | Spot Taker Fee | Futures Maker Fee | Futures Taker Fee |

|---|---|---|---|---|

| Binance | 0.1% | 0.1% | 0.02% | 0.04% |

| Bybit | 0.1% | 0.1% | 0.02% | 0.055% |

| OKX | 0.08% | 0.1% | 0.02% | 0.05% |

| KuCoin | 0.1% | 0.1% | 0.02% | 0.06% |

| Bitget | 0.1% | 0.1% | 0.02% | 0.06% |

Key Takeaways:

✔ Binance has the lowest futures taker fee (0.04%) compared to Bybit (0.055%) and OKX (0.05%).

✔ OKX offers the lowest spot maker fee (0.08%).

✔ Binance and OKX have competitive futures maker fees at 0.02%.

📊 Funding Fee & Withdrawal Fee Comparison

🔹 Funding Fee Comparison

Funding fees are charged on perpetual contracts every 8 hours. These rates vary based on market conditions.

| Exchange | Typical Funding Rate (BTC/USDT) | Funding Interval |

|---|---|---|

| Binance | 0.02% | Every 8 hours |

| Bybit | 0.02% | Every 8 hours |

| OKX | 0.015% | Every 8 hours |

| Bitget | 0.02% | Every 8 hours |

| Phemex | 0.01%-0.02% | Every 8 hours |

Key Takeaways:

✔ OKX has a slightly lower funding rate (0.015%) compared to Binance (0.02%).

✔ Phemex offers one of the lowest funding fees at 0.01% in some cases.

🔹 Withdrawal Fee Comparison

| Exchange | BTC Withdrawal Fee | ETH Withdrawal Fee | USDT (ERC-20) Fee |

|---|---|---|---|

| Binance | 0.0002 BTC | 0.00042 ETH | 10 USDT |

| Bybit | 0.0005 BTC | 0.00042 ETH | 10 USDT |

| OKX | 0.0002 BTC | 0.00042 ETH | 10 USDT |

| Bitget | 0.0006 BTC | 0.0005 ETH | 10 USDT |

| Phemex | 0.00057 BTC | 0.00042 ETH | 10 USDT |

Key Takeaways:

✔ Binance and OKX have the lowest BTC withdrawal fee (0.0002 BTC).

✔ USDT (ERC-20) withdrawal fee is high across all exchanges (10 USDT).

✔ ETH withdrawal fees are consistent across most exchanges.

📊 Cashback Comparison & VIP Programs

🔹 Binance Cashback & VIP Program vs. Other Exchanges

Binance offers one of the highest cashback programs, but how does it compare with competitors?

| Exchange | Max Cashback | Requirements | Cashback Type |

|---|---|---|---|

| Binance | 41% | VIP or referral | Spot & Futures Cashback |

| Bybit | 40-45% | Volume-based | Cashback & Bonus |

| OKX | 40% | VIP users | Fee Discounts |

| KuCoin | 60% | VIP users | Cashback & Discounts |

| Bitget | 40-47% | High volume traders | Cashback tiers |

Key Takeaways:

✔ Binance offers up to 41% cashback for both spot and futures traders.

✔ KuCoin provides the highest cashback (60%), but it is exclusive to VIP users.

✔ Bybit and Bitget have volume-based cashback programs, rewarding high-volume traders.

💡 Final Thoughts – Which Exchange is Best for Low Fees & Cashback?

- For the lowest spot trading fees ➝ OKX (0.08% maker fee)

- For the lowest futures trading fees ➝ Binance (0.04% taker fee)

- For the lowest funding fees ➝ Phemex (as low as 0.01%)

- For the lowest withdrawal fees ➝ Binance & OKX (0.0002 BTC)

- For the best cashback program ➝ Binance (41%) & KuCoin (60% for VIPs)

🔥 Want to maximize your savings? Sign up for Binance cashback today and get up to 41% rebate on trading fees! 🚀

FAQs: Common Questions About Binance Fees & Cashback

Here are the most frequently asked questions about Binance fees, cashback, and trading costs to help you navigate the platform more effectively.

Binance is known for its competitive fees compared to other major exchanges like Bybit, OKX, KuCoin, and Bitget. Spot trading fees are 0.1% for both makers and takers, while futures trading fees are 0.02% (maker) and 0.04% (taker). These rates are often lower than competitors, especially on futures contracts.

The funding fee on Binance applies to perpetual futures and is calculated every 8 hours. It reflects the difference between the perpetual contract price and the spot price. For example, if the funding rate is 0.02%, a $10,000 position would incur a $2 fee. Traders can minimize this by monitoring rates and trading during lower-fee periods.

Yes, Binance offers zero-fee trading on selected spot trading pairs such as BTC/TUSD and BNB/TUSD. This allows users to save significantly on fees, especially when trading stablecoin pairs.

Binance.US is a separate platform that operates under U.S. regulations. It offers over 150 trading pairs and charges 0.1% trading fees, with some zero-fee pairs like BTC/USD, BTC/USDT, and BTC/BUSD. It’s designed specifically for U.S.-based users.

Deposits on Binance are free of charge. Withdrawal fees vary based on the asset and network. For instance, withdrawing USDT on ERC-20 costs 10 USDT, while withdrawing on BEP-20 costs only 0.29 USDT, making BEP-20 a more cost-efficient choice.

Binance offers cashback on trading fees based on volume and VIP tier. Users can get up to 41% cashback on spot trading and up to 40% on futures. This rate is competitive, often exceeding the cashback offered by Bybit (40–45%) and Bitget (40–47%).

Conclusion & Final Thoughts

Pros & Cons of Binance Fees & Cashback

✅ Pros: Low trading fees, zero-fee pairs, high cashback (up to 41%)

❌ Cons: Withdrawal fees vary by network, Binance.US has limited pairs

Should You Use Binance for Lower Trading Costs?

If you want competitive trading fees, VIP discounts, and high cashback, Binance is one of the best choices.

🔹 Next Steps: What You Need to Do

✅ Compare Binance fees using our fee calculator

✅ Register for cashback & save on trading costs

✅ Join our community for the latest crypto exchange updates

🔗 Read More:

📖 Binance vs. Bybit Fees – Which Exchange is Cheaper?

📖 How to Maximize Cashback on Crypto Exchanges

📖 Top 5 Crypto Exchanges with Lowest Fees

🔗 Binance Official Fee Structure

🔗 Crypto Best Exchange – Cashback Offers

📢 Follow & Join Us for More Crypto Cashback Deals!

🔹 Facebook: Crypto Best Exchange

🔹 Telegram: Crypto Best Exchange Community

Crypto Trading Platforms & Apps

Crypto Trading Platforms & Apps Best Crypto Trading Apps & Platforms

Best Crypto Trading Apps & Platforms Crypto Futures & Leverage Trading

Crypto Futures & Leverage Trading Buying & Selling Crypto

Buying & Selling Crypto Automated & Software Trading

Automated & Software Trading